Bankruptcy B 201B 2009-2026 free printable template

Show details

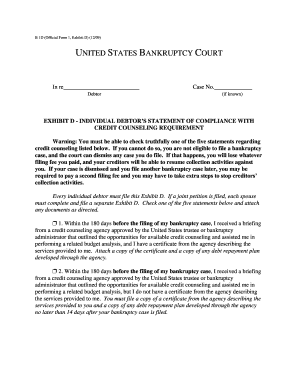

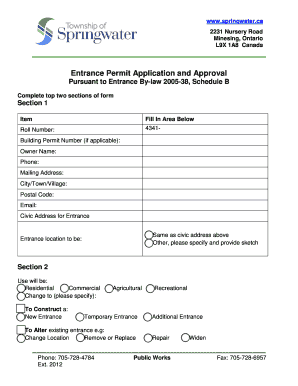

B 201B Form 201B 12/09 UNITED STATES BANKRUPTCY COURT District Of In re Debtor Case No. Chapter CERTIFICATION OF NOTICE TO CONSUMER DEBTOR S UNDER 342 b OF THE BANKRUPTCY CODE Certification of Non-Attorney Bankruptcy Petition Preparer I the non-attorney bankruptcy petition preparer signing the debtor s petition hereby certify that I delivered to the debtor the attached notice as required by 342 b of the Bankruptcy Code. Printed name and title if any of Bankruptcy Petition Preparer Address...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign notice bankruptcy attorney form

Edit your debtor bankruptcy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditor attorney form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bankruptcy b 201b online online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit debtor attorney form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bankruptcy attorney written form

How to fill out Bankruptcy B 201B

01

Start by downloading the Bankruptcy B 201B form from the official court website.

02

Fill in your name, address, and other personal details at the top of the form.

03

Provide information about any co-debtors, if applicable.

04

Complete the section detailing your debts, including secured and unsecured debts.

05

List your monthly income and necessary expenses to show your financial situation.

06

Include any additional information requested, such as previous bankruptcy filings or legal actions.

07

Review all the information for accuracy before signing and dating the form.

08

Submit the completed form along with any required attachments to the bankruptcy court.

Who needs Bankruptcy B 201B?

01

Individuals or business entities filing for bankruptcy under Chapter 7 or Chapter 13.

02

Debtors seeking to disclose their financial situation and liabilities.

03

Those who have completed the pre-bankruptcy counseling requirement and are moving forward with filing.

Fill

notice read creditors

: Try Risk Free

People Also Ask about notice bankruptcy creditors

What is the success rate of Chapter 7 bankruptcy?

Success Rate: Given that more than 99% of Chapter 7 cases are discharged, your Chapter 7 bankruptcy will likely be a success (so long as you follow the rules and don't commit fraud). Debt Survival: You may still have to pay certain debts, such as a mortgage lien, child support or alimony, once bankruptcy is over.

What happens if I declare bankruptcy?

If you are made a bankrupt, a trustee in bankruptcy will be appointed to take charge of your available assets and sell them to pay your creditors. This may be the Official Assignee (OA), a public servant or a private trustee in bankruptcy (PTIB).

What is the downside of filing for bankruptcy?

The downsides to filing for bankruptcy include losing assets of value, damaging your credit and having difficulties acquiring loans in the future. The upsides include keeping your property, no longer receiving calls from collections and getting an opportunity to regain control of your financial life.

Does Chapter 7 bankruptcy ever get denied?

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors;

Does bankruptcy harm a person's credit report?

Filing for bankruptcy can hurt an individual's credit, and the impact can last for years. A Chapter 7 bankruptcy may stay on credit reports for 10 years from the filing date, while a Chapter 13 bankruptcy generally remains for seven years from the filing date.

Is filing for bankruptcy a big deal?

Filing for bankruptcy is sometimes the right decision, but it is not without consequences. Those include: Your credit will be shot. Anyone considering bankruptcy needs to keep in mind that their credit reports and credit score will take a major hit—one that can last for years.

What is the rule 2030 for bankruptcy?

Here is the crux of the appellate court's holding: “Section 2030 provides that family courts 'shall ensure that each party has access to legal representation, including access early in the proceedings,' by awarding pendente lite attorney fees when certain statutory conditions are met. (§ 2030, subd.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get certificate of bankruptcy?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the bankruptcy certificate in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in Bankruptcy B 201B?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your Bankruptcy B 201B to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in Bankruptcy B 201B without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing Bankruptcy B 201B and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is Bankruptcy B 201B?

Bankruptcy B 201B is a specific form used in the bankruptcy process, particularly for Chapter 7 and Chapter 13 cases, which requires debtors to provide detailed financial information.

Who is required to file Bankruptcy B 201B?

Individuals filing for Chapter 7 or Chapter 13 bankruptcy must file Bankruptcy B 201B to disclose their financial situation to the court.

How to fill out Bankruptcy B 201B?

To fill out Bankruptcy B 201B, debtors should accurately provide personal and financial information as required, including income, expenses, assets, and liabilities, ensuring all information is complete and truthful.

What is the purpose of Bankruptcy B 201B?

The purpose of Bankruptcy B 201B is to collect essential financial information from the debtor to facilitate the bankruptcy process and assist the court in assessing the debtor's financial situation.

What information must be reported on Bankruptcy B 201B?

Bankruptcy B 201B requires reporting of personal identification details, income sources, monthly expenses, a list of assets, liabilities, and any other financial information relevant to the bankruptcy case.

Fill out your Bankruptcy B 201B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy B 201b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.